The property and casualty insurance industry has undergone a remarkable transformation, turning a USD 8.5 billion underwriting loss in Q1 2023 into a USD 9.3 billion gain in Q1 2024, with a combined ratio of 94.2%. This is a clear sign of profitability, as ratios below 100% indicate strong performance. However, as the industry continues to evolve, staying ahead of the competition requires insurers to adopt innovative technologies that meet changing customer needs and expectations.

Generative AI (Gen AI) is emerging as one of the most promising tools reshaping the insurance industry. A recent Deloitte survey found that 75% of U.S. insurers are already utilizing Gen AI in some capacity, particularly for tasks like claims processing and customer service. But scaling its use throughout the entire organization is not without its challenges. Issues like data security, privacy concerns, and integrating new technologies into existing systems present hurdles for insurers.

While the potential benefits of Gen AI are immense, the risks are equally significant. Insurers need to carefully consider the compliance, operational, and security challenges of adopting such advanced technologies to ensure they maximize its value while maintaining governance and profitability.

How Generative AI is Changing Insurance Operations

A report by Capgemini Research Institute predicts that by 2025, 67% of leading insurers will be using large language models insurance to enhance customer experiences and optimize business operations.

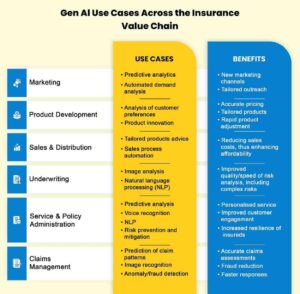

What sets Gen AI apart from traditional AI is its ability to create new data and content rather than simply analyzing existing information or automating routine tasks. This capability is opening up new possibilities in various areas of the insurance process. Here’s a look at how Gen AI is making a difference:

Automating Policy Creation and Accelerating Claims Processing

One of the most valuable applications of large language models insurance is the automation of policy document creation. By inputting customer data, Gen AI can quickly generate customized policy documents that comply with regulatory standards while addressing individual customer needs. This eliminates much of the time and effort typically spent manually drafting documents.

In claims processing, Gen AI is helping insurers streamline operations. By working alongside underwriters, actuaries, and claims adjusters, Gen AI can analyze and synthesize data from various sources—such as call transcripts, medical records, and legal documents. This boosts productivity, speeds up the claims process, and improves accuracy, particularly in the property and casualty sector.

Using Synthetic Data for Risk Modeling and Prediction

Another major advantage of large language models insurance is its ability to create synthetic datasets that simulate different risk scenarios. These simulated datasets are built from real historical data and can be used to train machine learning models in areas like fraud detection and risk assessment.

By using these realistic synthetic datasets, insurers can more accurately assess risks and predict future outcomes. This leads to better pricing, more effective risk management, and a competitive edge in the marketplace.

Personalized Marketing and Enhanced Customer Engagement

Gen AI is also helping insurers create personalized marketing content tailored to individual customers. By analyzing customer preferences and behaviors, Gen AI can generate targeted marketing materials, such as brochures, blog posts, and social media content. This personalized approach increases customer engagement and drives higher conversion rates.

Additionally, Gen AI can automate customer communication, such as policy updates, service emails, and reminders. This ensures timely, relevant interactions with customers, improving satisfaction and fostering stronger relationships. However, it’s still essential for humans to review AI-generated content to ensure accuracy and quality.

Improving Customer Service with AI-Powered Conversations

Some insurers are integrating Gen AI into their customer service systems to provide more natural, context-aware interactions. Gen AI analyzes past customer interactions and policy details to offer personalized, accurate responses to inquiries. For example, when a customer asks about the status of a claim or their policy coverage, the AI can provide real-time information pulled directly from internal systems, reducing the need for human intervention and speeding up response times.

By adopting Gen AI, insurers can improve the efficiency of their customer service teams while also providing a more personalized, responsive experience for clients.

Risks of Generative AI in the Insurance Industry

While Generative AI offers vast potential for improving efficiency and customer experience, it also comes with risks that insurers must carefully manage. These risks center around ensuring the accuracy, security, and compliance of AI-generated content and decisions.

Dealing with AI “Hallucinations” and Maintaining Accuracy

One of the key challenges with Gen AI is the phenomenon of “hallucinations”—when the AI generates outputs that are plausible-sounding but incorrect. In the context of insurance, such inaccuracies could lead to incorrect risk assessments, improper policy pricing, or faulty claims decisions. These mistakes could undermine the trustworthiness of the underwriting and claims processes.

Despite this, Gen AI can still provide significant value by automating routine tasks and improving the consistency of policy documents. To mitigate the risks of hallucinations, insurers are implementing validation checks and maintaining human oversight to verify AI-generated content and decisions before they are finalized.

Protecting Against Adversarial Attacks and System Vulnerabilities

Generative AI systems can also be vulnerable to adversarial attacks, where malicious actors manipulate inputs to trick the AI into making incorrect or biased decisions. In the insurance sector, this could result in the approval of fraudulent claims or the alteration of risk assessments to benefit bad actors.

To protect against these threats, insurers must implement robust security measures, such as data encryption, secure training practices for AI models, and regular audits. Strong authentication methods and continuous monitoring of AI systems for unusual behavior are also essential for identifying and addressing potential vulnerabilities.

Balancing Innovation with Risk Management

Generative AI offers exciting opportunities for insurers to improve efficiency, enhance customer experiences, and stay competitive in a rapidly evolving market. However, insurers must be mindful of the risks involved and adopt best practices for security, compliance, and oversight to ensure that AI technologies are deployed responsibly.

The key to successfully integrating Gen AI into insurance operations lies in balancing innovation with effective risk management. By taking a careful and thoughtful approach, insurers can harness the full potential of Gen AI while maintaining customer trust and operational integrity.