Attention all QuickBooks Desktop Payroll users! Get ready for an exciting upgrade! Introducing the upcoming subscription for QuickBooks Desktop Payroll, designed to take your payroll management to the next level.

With a slew of enhanced features and functionalities, this new subscription will ensure seamless and efficient payroll processing for your business.

Whether you’re a small business owner or an accounting professional, this upgrade will revolutionize the way you handle payroll.

Say goodbye to manual calculations and administrative hassles. The upcoming subscription for QuickBooks Desktop Payroll will automate complex tasks, saving you time and improving accuracy.

Stay tuned for an in-depth look at the new features and benefits that this subscription has to offer.

From simplified tax filing to effortless paycheck calculations, you won’t want to miss out on the transformation it brings to your payroll process.

Benefits of Using QuickBooks Desktop Payroll

QuickBooks Desktop Payroll is not just a tool; it’s a gateway to streamlining your business’s payroll process. The benefits of utilizing such a robust system are manifold.

Firstly, it significantly reduces the time spent on payroll management, allowing you to focus on other crucial areas of your business.

The automation of tasks minimizes the risk of human error, ensuring that your employees are paid accurately and on time.

Moreover, QuickBooks Desktop Payroll is designed to keep you compliant with the latest tax laws, automatically updating to reflect any changes.

This proactive approach to compliance can save you from potential fines and penalties associated with payroll taxes. Additionally, the platform provides detailed reports that give you insights into your payroll expenses, helping you to make informed financial decisions.

Overview of Upcoming Subscription for QuickBooks Desktop Payroll

The anticipation surrounding the upcoming subscription for QuickBooks Desktop Payroll is well-founded.

This new offering is set to introduce a range of features and enhancements that will redefine payroll processing. Central to the upgrade is a focus on automation, user-friendliness, and comprehensive support.

Users can look forward to a more intuitive interface that simplifies navigation and makes payroll tasks more straightforward.

The automation of tax calculations and filings, coupled with direct deposit capabilities, means that managing payroll will take a fraction of the time it used to.

Moreover, the subscription will offer enhanced customer support, providing users with the assistance they need when they need it.

The goal of this upgrade is clear: to provide a payroll solution that is not only powerful but also accessible to businesses of all sizes.

By listening to user feedback and analyzing the latest trends in payroll management, QuickBooks is poised to offer a subscription that truly meets the needs of modern businesses.

Key Features and Enhancements in the New Subscription

Delving deeper into the upcoming subscription reveals a suite of key features and enhancements that stand out.

Among these is the advanced tax management system, designed to automate the entire tax process. This system ensures that all filings are accurate and submitted on time, reducing the workload on business owners and accountants.

Another highlight is the enhanced reporting functionality. Users will have access to a wider range of customizable reports, providing deeper insights into payroll data.

This feature is invaluable for strategic planning, allowing businesses to optimize their payroll processes and allocate resources more effectively.

Furthermore, the new subscription will integrate seamlessly with other QuickBooks products, offering a unified experience.

This integration facilitates the sharing of data across platforms, streamlining financial management and reporting.

Highly recommended: QuickBooks Payroll Update Not Working

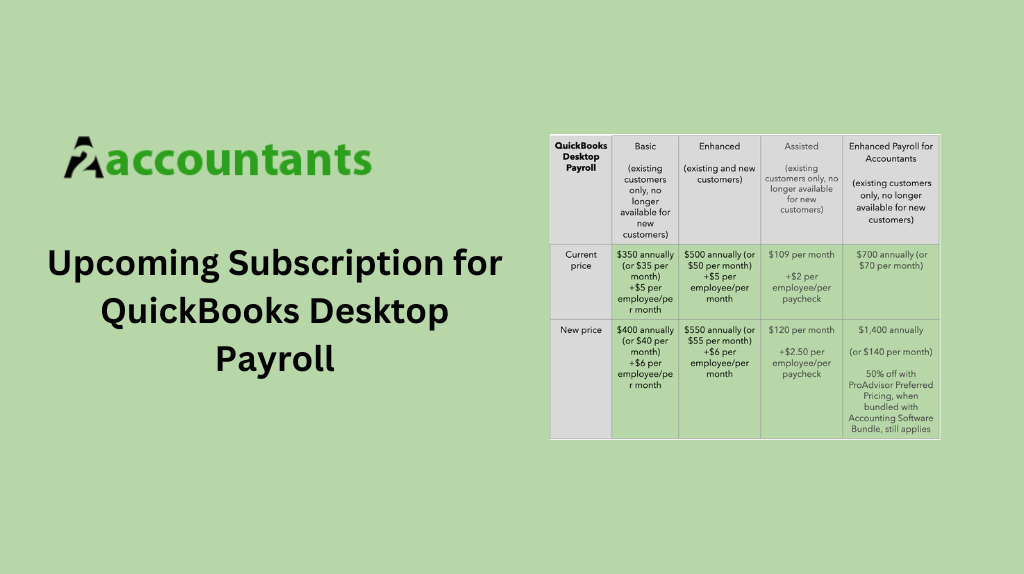

Pricing and Plans for the Upcoming Subscription

Understanding the pricing and plans for the upcoming subscription is crucial for businesses considering QuickBooks Desktop Payroll.

While specific details are yet to be announced, it’s expected that the pricing structure will be competitive, offering various plans to suit different business needs.

The subscription is likely to include tiered options, ranging from basic payroll processing to more advanced features like tax filing assistance and premium customer support.

This flexible approach ensures that businesses only pay for the features they need, making the subscription a cost-effective solution for managing payroll.

Moreover, QuickBooks is known for offering transparent pricing with no hidden fees, and the upcoming subscription is expected to follow this principle.

This transparency allows businesses to budget effectively, knowing exactly what their payroll costs will be.

How to Upgrade to the New Subscription

For current QuickBooks Desktop Payroll users, upgrading to the new subscription will be a straightforward process.

QuickBooks is committed to making the transition as smooth as possible, with detailed guidance and support available every step of the way.

The upgrade process will involve a few simple steps, starting with a notification to existing users about the availability of the new subscription.

Users will then be guided through the process, which will include backing up current payroll data, choosing the appropriate plan, and activating the new subscription.

QuickBooks will provide comprehensive support throughout this process, ensuring that businesses can make the switch without any disruption to their payroll operations.

Frequently Asked Questions About the Upcoming Subscription

With any new offering, there are bound to be questions. Some of the most frequently asked questions about the upcoming subscription for QuickBooks Desktop Payroll include:

- What are the main differences between the current and new subscriptions?

- Will there be any downtime during the upgrade process?

- How will the new features impact my current payroll process?

- Are there any additional costs associated with upgrading?

- What kind of support can I expect during and after the upgrade?

QuickBooks is preparing comprehensive answers to these and other questions, ensuring that users have all the information they need to make an informed decision about the new subscription.

Also visit: How to Calculate Sales Tax in QuickBooks Desktop

Comparison with Other Payroll Solutions in the Market

When evaluating the upcoming subscription for QuickBooks Desktop Payroll, it’s helpful to consider how it stacks up against other payroll solutions in the market.

This comparison highlights the unique value proposition of QuickBooks, emphasizing its commitment to automation, accuracy, and user support.

Unlike some solutions that cater primarily to larger businesses, QuickBooks Desktop Payroll is designed to meet the needs of small and medium-sized businesses.

Its intuitive interface, comprehensive features, and competitive pricing make it a standout choice for businesses looking for a reliable payroll solution.

Furthermore, QuickBooks’ focus on innovation and integration with other financial tools offers businesses a level of convenience and efficiency that is hard to match.

This holistic approach to payroll and financial management sets QuickBooks apart from the competition.

Testimonials from Businesses Using QuickBooks Desktop Payroll

Hearing from businesses that have already benefited from QuickBooks Desktop Payroll can provide valuable insights into the impact of this solution.

Many users highlight the time savings and reduced stress associated with managing payroll, thanks to QuickBooks’ automation and accuracy.

Others praise the comprehensive support provided by QuickBooks, from the initial setup to ongoing assistance with payroll questions.

These testimonials underscore the positive experiences of businesses of all sizes, reinforcing QuickBooks’ reputation as a trusted provider of payroll solutions.

Conclusion

The upcoming subscription for QuickBooks Desktop Payroll represents a significant step forward in payroll management.

With its focus on automation, user-friendliness, and comprehensive support, it promises to deliver an unparalleled payroll processing experience.

As businesses look to streamline their operations and focus on growth, having a reliable, efficient payroll solution becomes increasingly important.

QuickBooks Desktop Payroll, with its upcoming subscription, is poised to meet and exceed these needs, solidifying its position as a leader in payroll solutions.