Introduction

Vinyl Chloride Monomer (VCM) is a vital chemical compound primarily used in the production of polyvinyl chloride (PVC), one of the world’s most versatile plastic materials. VCM is a colorless, flammable gas with a mild, sweet odor. It plays a central role in industrial manufacturing, construction, packaging, healthcare, automotive, and many other sectors. Given its integral applications and growing demand for PVC, the VCM market has evolved into a key component of the global petrochemical landscape.

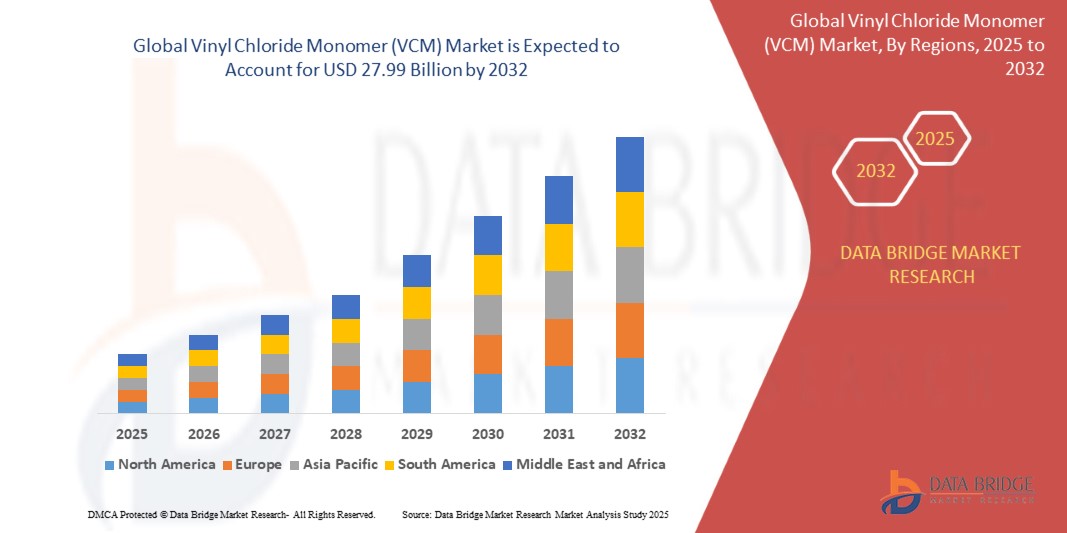

Market Size

The Vinyl Chloride Monomer market size was valued at USD 17.10 billion in 2024 and is projected to reach USD 27.99 billion by 2032, with a CAGR of 6.35% during the forecast period of 2025 to 2032.

For more information:

https://www.databridgemarketresearch.com/reports/global-vinyl-chloride-monomer-vcm-market

Market Trends

VCM’s market growth is being shaped by several significant trends. The push toward lightweight and durable materials in construction and automotive sectors is fueling the demand for PVC, thereby indirectly influencing VCM. The rising popularity of modular construction is also boosting PVC usage, given its low weight, strength, and versatility.

In recent years, manufacturers have adopted more sustainable production practices. These include energy-efficient processes, recycling of chlorine during synthesis, and minimization of emissions. This trend aligns with increasing regulatory pressure on petrochemical companies to reduce their carbon footprint.

Another noticeable trend is the growing investment in bio-based alternatives to traditional petrochemical VCM. While still in early stages, bio-based feedstocks for VCM could transform the industry in the coming decade. Startups and research institutions are exploring alternatives that reduce reliance on fossil fuels, although commercial viability remains a challenge.

Market Share

Asia-Pacific dominates the global VCM market, accounting for more than 60% of total production and consumption. China remains the largest single contributor due to its massive construction industry, expanding urban landscape, and large-scale manufacturing sector. India, Southeast Asia, and South Korea are also emerging as major hubs, with increased demand for PVC in infrastructure and utilities.

North America holds the second-largest market share, backed by steady construction activity and robust industrial output. The United States is the key player in this region, benefiting from strong petrochemical infrastructure and technological innovation in VCM production.

Europe maintains a significant share as well, though the region is experiencing relatively slower growth compared to Asia-Pacific. Stringent environmental regulations and high energy costs have impacted production levels in some European countries. However, the demand for eco-friendly and recyclable PVC products is keeping the region’s VCM consumption stable.

The Evolution

The Vinyl Chloride Monomer market has undergone significant transformation since its inception in the early 20th century. Initially developed as a laboratory curiosity, VCM gained industrial relevance with the rise of synthetic materials. By the mid-1900s, PVC became widely used in post-war reconstruction, giving rise to commercial VCM production.

Over the decades, technological advancements improved the safety, efficiency, and scale of VCM manufacturing. Modern VCM production uses thermal cracking of ethylene dichloride (EDC), a process that yields high efficiency and large outputs. Improved catalysts and process automation have enabled producers to minimize waste, cut costs, and comply with tightening safety regulations.

In the 2000s, VCM’s link to environmental and health concerns led to stricter monitoring of its production and storage. It is classified as a human carcinogen, necessitating closed-loop systems and rigorous safety standards. This evolution brought about a dual focus: increasing output while minimizing occupational exposure and environmental impact.

Market Trends (Revisited)

Technological innovation continues to shape the future of VCM. Digital monitoring, predictive maintenance, and process optimization are becoming standard in VCM plants worldwide. These tools reduce downtime, improve yields, and enhance worker safety.

Green chemistry initiatives are slowly entering the market, with some firms exploring catalytic conversion routes that reduce energy use. There is also growing interest in capturing and reusing the byproducts of VCM production, enhancing overall plant efficiency.

In terms of end-use industries, the construction sector remains dominant. However, VCM’s role in healthcare packaging, electrical insulation, and automotive parts is gaining momentum. The durability, chemical resistance, and cost-effectiveness of PVC make it a preferred material in new-age applications.

Export and import patterns are shifting as well. With China becoming more self-reliant in chemical production, Southeast Asian and Middle Eastern countries are positioning themselves as key exporters to European and African markets.

Factors Driving Growth

Population growth and urban expansion are primary drivers. More people mean more homes, offices, water supply systems, and power infrastructure — all of which require PVC products.

The global infrastructure boom, especially in emerging markets, is further elevating VCM demand. Governments are investing heavily in housing, sanitation, and transportation, all of which lean on PVC solutions.

Cost efficiency is another growth factor. PVC, made from VCM, offers a compelling price-to-performance ratio compared to other materials. This affordability ensures continued preference across industries, even during economic downturns.

Rising demand for electrical and communication cables — many of which use PVC insulation — is another contributing factor. As digitization accelerates, the need for reliable, insulated cabling rises, indirectly boosting the VCM market.

Climate resilience is also becoming a consideration. PVC products derived from VCM are resistant to moisture, chemicals, and weathering, making them ideal for flood-prone and coastal regions.

Increased emphasis on sanitation and water management, especially post-COVID-19, is leading to a spike in demand for PVC pipes and fittings. This has a direct impact on VCM production volumes.