Market Overview 2025-2033

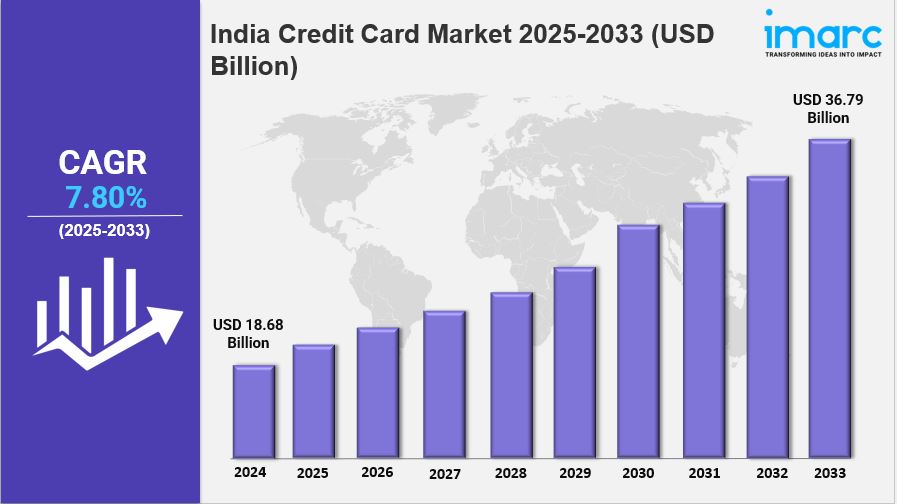

The India credit card market size reached USD 18.68 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 36.79 Billion by 2033, exhibiting a growth rate (CAGR) of 7.80% during 2025-2033.

The India credit card market is witnessing significant expansion, fueled by increasing digitalization, a growing middle class, and enhanced access to credit facilities. Key trends include the rising popularity of rewards and cashback programs, with major players emphasizing customer-centric features and secure transaction technologies.

Key Market Highlights:

✔️ Strong growth driven by digital adoption and financial inclusion.

✔️ Increasing popularity of rewards programs and cashback offers.

✔️ Enhanced focus on secure payment technologies and user experience.

Request for a sample copy of the report: https://www.imarcgroup.com/india-credit-card-market/requestsample

India Credit Card Market Trends and Driver:

The India credit card market is poised for transformative growth, driven by a confluence of technological advancements and evolving consumer preferences. As more individuals gain access to digital banking services, the market is projected to expand significantly.

In 2025, the market size is expected to reach unprecedented levels, reflecting a robust increase in the number of active credit card users. This surge is largely attributed to the growing middle class and their increasing financial literacy, which encourages the adoption of credit facilities.

India’s credit card market share is becoming increasingly competitive, with numerous players vying for consumer attention. Major banks and fintech companies are innovating their offerings to capture a larger segment of the market. As of 2025, traditional banks are likely to face stiff competition from digital-first players that provide unique features such as instant approvals and personalized rewards. This shift is leading to a more dynamic landscape where customer experience and satisfaction are paramount.

The growth trajectory of the India credit card market is also influenced by changing spending habits. Consumers are increasingly opting for credit cards that offer rewards, cashback, and travel benefits. In 2025, the demand for such features is expected to escalate, prompting issuers to enhance their product offerings. Furthermore, the integration of advanced technologies like artificial intelligence and machine learning is enabling better risk assessment and fraud detection, further boosting consumer confidence in credit card usage.

As the market continues to evolve, regulatory frameworks will play a crucial role in shaping its future. The Reserve Bank of India (RBI) is likely to implement measures that promote transparency and consumer protection, which will be essential for sustaining growth.

By 2025, these regulations will help ensure a balanced and secure environment for both consumers and financial institutions, fostering a healthy and competitive credit card market in India.

Speak to An Analyst: https://www.imarcgroup.com/request?type=report&id=30861&flag=C

India Credit Card Market Segmentation: The market report segments the market based on product type, distribution channel, and region:

Study Period:

Base Year: 2024

Historical Year: 2019-2024

Forecast Year: 2025-2033

Type Insights:

- General Purpose

- Private Label

Service Providing Company Insights:

- Visa

- Mastercard

- RuPay

- Others

Credit Score Insights:

- 300-500

- 501-700

- 701-850

- Above 851

Credit Limit Insights:

- Up to 25K

- 25-50K

- 51K-2L

- 2L-5L

Card Type Insights:

- Base

- Signature

- Platinum

Benefits Insights:

- Cashback

- Voucher

Regional Insights:

- North India

- South India

- East India

- West India

Competitive Landscape:

The market research report offers an in-depth analysis of the competitive landscape, covering market structure, key player positioning, top winning strategies, a competitive dashboard, and a company evaluation quadrant. Additionally, detailed profiles of all major companies are included.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145