Europe Confectionery Market Size and Share Analysis – Growth Trends and Forecast Report 2025-2033

Market Overview

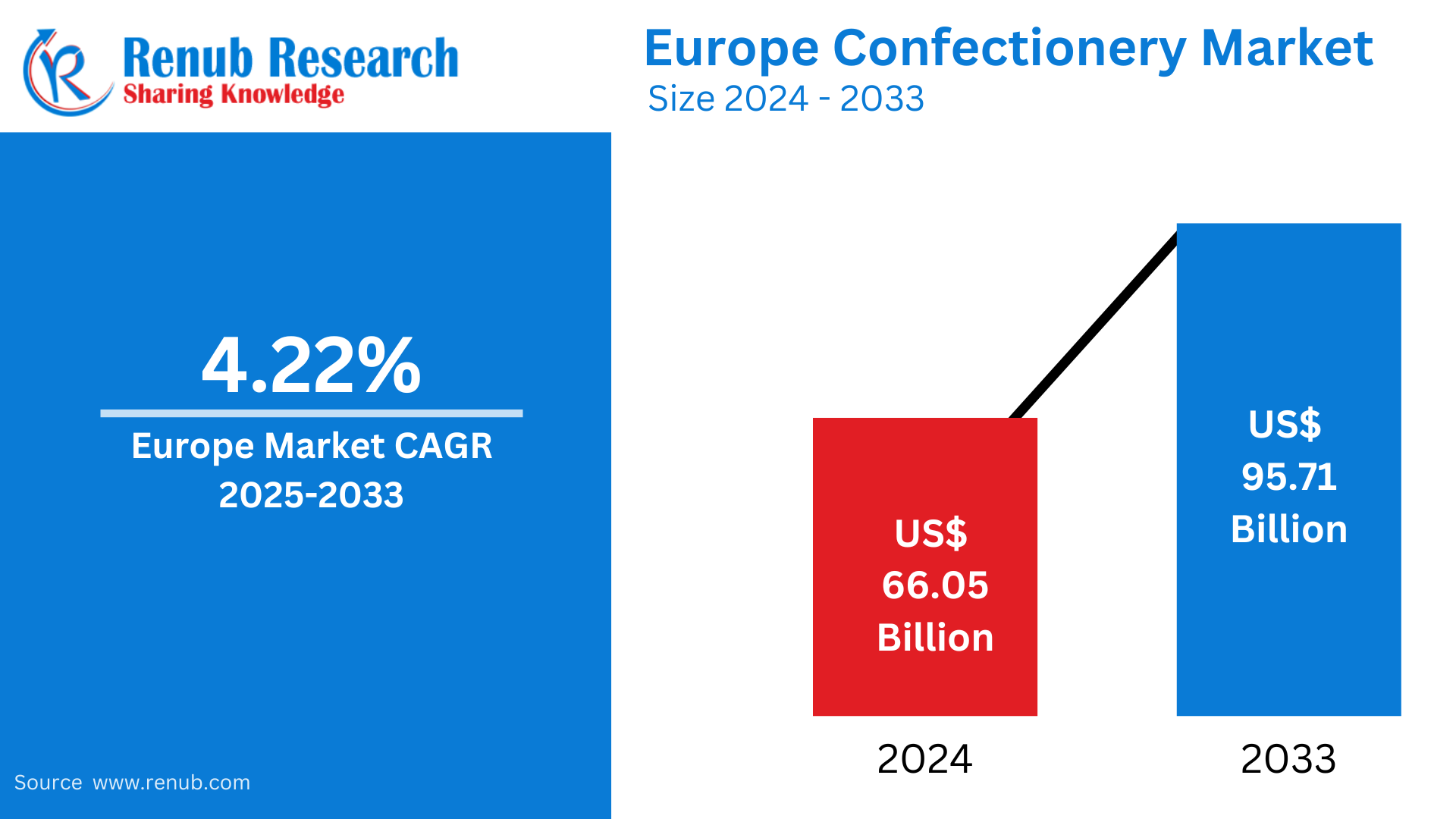

The European confectionery market, valued at USD 66.05 billion in 2024, is expected to reach USD 95.71 billion by 2033, growing at a CAGR of 4.22% from 2025 to 2033. This growth is driven by a surge in consumer preferences, innovations in products, and rising demand for healthier and premium options. The market includes various confectionery products, such as chocolate, gums, snack bars, and sugar-based candies, sold through multiple distribution channels like convenience stores, supermarkets, hypermarkets, and online platforms.

Key Factors Driving Growth

- Health-Conscious Trends: With an increasing focus on healthier lifestyles, there is a growing demand for sugar-free, low-calorie, and organic confectionery products. Consumers are shifting towards healthier alternatives without compromising on taste, prompting manufacturers to innovate with natural sweeteners, reduced sugar, and fortified options.

- Premiumization: Consumers are increasingly willing to pay more for premium-quality confectionery items, including artisanal chocolates and limited-edition candies. This trend has spurred innovation in the industry, with luxury products such as handmade chocolates and upscale packaging gaining popularity, especially in the chocolate and candy segments.

- E-Commerce Growth: Online shopping platforms have revolutionized the European confectionery market. Consumers can now easily access a variety of confectionery products from both local and international brands, which has fueled the growth of online retail sales. The convenience of home delivery and the ability to compare prices have contributed to this expansion.

Challenges Facing the Market

- Regulatory Pressure on Sugar Consumption: Governments across Europe are enforcing policies like sugar taxes and product reformulation programs to curb sugar consumption. These regulations challenge manufacturers to innovate by reducing sugar content without compromising on flavor, which could lead to higher production costs.

- Sustainability and Environmental Concerns: As sustainability becomes a major issue, confectionery brands are under increasing pressure to reduce their environmental footprint. This includes adopting sustainable packaging solutions and ensuring the ethical sourcing of ingredients. Meeting sustainability requirements can increase production costs and complicate manufacturing processes.

Market Segmentation

- Confections: This segment includes chocolate (dark, milk, and white), gums (bubble gum, chewing gum, sugar-free varieties), and snack bars (cereal bars, protein bars, fruit and nut bars). The demand for chocolate, particularly dark and premium varieties, remains robust, driven by changing consumer preferences and innovations in flavors.

- Sugar Confectionery: Hard candies, lollipops, mints, and sugar-free options are popular across Europe. The growth of premium, functional, and limited-edition candy products has driven innovation in this segment.

- Distribution Channels: Confectionery products are sold through various channels, including convenience stores, supermarkets, hypermarkets, and online retail platforms. Online shopping, in particular, has witnessed significant growth, with 75% of internet users aged 16-74 in Europe purchasing goods online in 2023.

New Publish Reports

- Europe Snack Bar Market Size and Share Analysis – Growth Trends and Forecast Report 2025-2033

- North America Snack Bar Market Size and Share Analysis – Growth Trends and Forecast Report 2025-2033

- China Online Grocery Market, by Segments (Packaged Food, Dairy, Sweet Biscuits, Snack Bars and Fruit Snacks, and Soup), by Channel, Company Analysis & Forecast

Key Market Trends

- Innovation in Product Flavors and Formats: Manufacturers are continually innovating with new flavors, shapes, and packaging to meet the diverse demands of European consumers. The growing preference for organic, sugar-free, and functional confectionery products is driving innovation.

- Health-Oriented Products: The rise of health-conscious consumers has led to a demand for confectionery products with added health benefits, such as fiber, vitamins, and plant-based ingredients. This trend has influenced various product categories, particularly in chocolate and gums.

Country Analysis

- Belgium: Known for its premium chocolate, Belgium’s market is driven by both domestic demand and international exports. Belgian chocolate brands like Godiva and Neuhaus are synonymous with luxury, and the country is at the forefront of artisanal and organic confectionery innovation.

- Germany: Germany boasts a rich confectionery tradition, particularly in marzipan and gummy sweets. The market is increasingly leaning towards organic and sugar-free options, as sustainability becomes a central issue in the country’s production processes.

- Spain: Spain’s market is characterized by its blend of traditional sweets and an increasing preference for healthier confectionery options, including sugar-free and organic products. The demand for high-quality, locally sourced ingredients also plays a crucial role in shaping the market.

- United Kingdom: The UK is one of the largest confectionery markets in Europe. Major players like Cadbury and Mars dominate the sector, with increasing demand for premium products and healthier alternatives. Sustainability concerns are driving changes in packaging and ingredient sourcing.

Key Questions Answered

- What is the projected market size of the European confectionery market by 2033? The European confectionery market is projected to reach USD 95.71 billion by 2033.

- What is the expected CAGR of the European confectionery market from 2025 to 2033? The expected CAGR is 4.22% from 2025 to 2033.

- What are the major factors driving the growth of the European confectionery market? Key drivers include health-conscious trends, premiumization, and the growth of e-commerce.

- How are health-conscious trends influencing the confectionery industry in Europe? There is a growing demand for healthier options, including sugar-free, low-calorie, and organic products, influencing product formulations and packaging.

- What role does premiumization play in shaping consumer preferences in the confectionery market? Premiumization has led to a preference for high-quality, artisanal products with unique flavors and luxury packaging.

- How is e-commerce expansion impacting confectionery sales across Europe? E-commerce has significantly expanded consumer access to a wider range of confectionery products, driving market growth.

- What are the key regulatory challenges affecting sugar consumption in confectionery products? Sugar taxes and product reformulation programs are creating challenges for manufacturers to reduce sugar content without compromising on taste.

- How are sustainability concerns influencing confectionery packaging and production in Europe? Confectionery companies are adopting sustainable packaging solutions and sourcing ingredients ethically to meet growing environmental expectations.

- Which European country dominates the confectionery market? Germany, Belgium, and the United Kingdom are among the dominant players in the European confectionery market.

- How are innovations in confectionery products influencing market growth? Innovations in flavor, packaging, and product formats are key to attracting health-conscious and premium-seeking consumers.

Conclusion

The European confectionery market is evolving rapidly, driven by shifts in consumer preferences for healthier, premium, and sustainable products. While the market faces challenges such as regulatory pressures and sustainability concerns, these trends offer significant opportunities for growth and innovation. Brands that adapt to these changes are poised to succeed in the competitive European market.