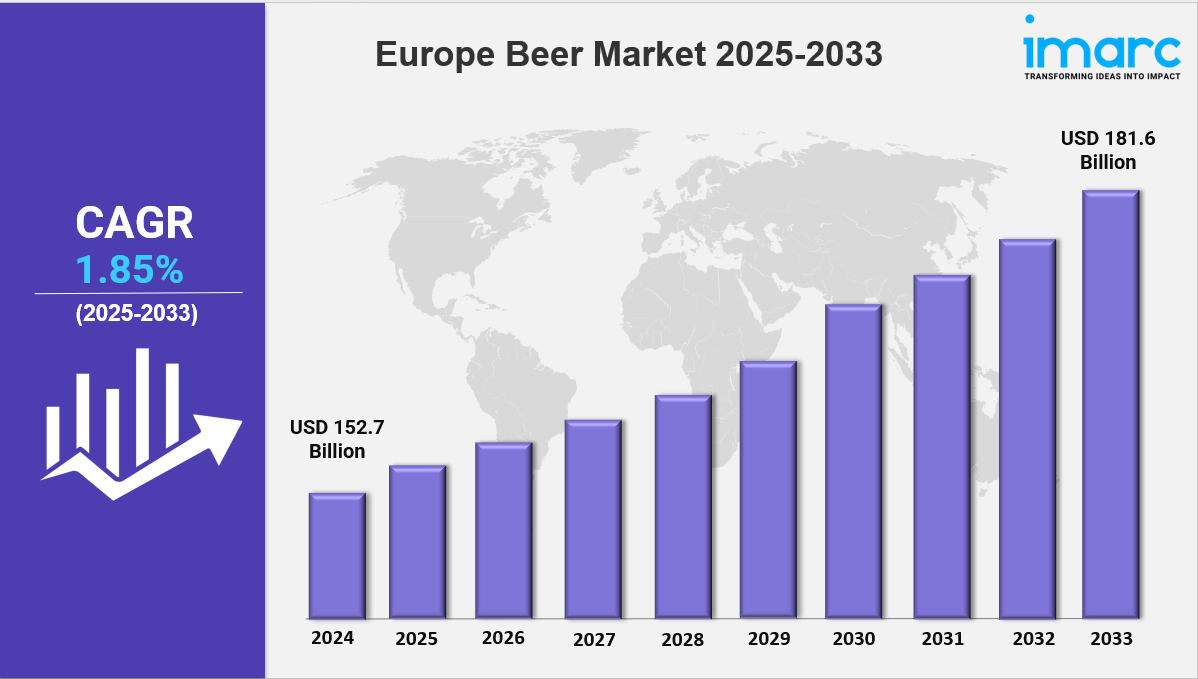

Market Overview 2025-2033

The Europe beer market size was valued at USD 152.7 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 181.6 Billion by 2033, exhibiting a CAGR of 1.85% from 2025-2033. The market is expanding due to rising consumer demand, craft beer trends, and premium product innovations. Sustainability initiatives, changing preferences, and technological advancements are driving growth, making it a dynamic and competitive industry.

Key Market Highlights:

✔️ Steady market growth driven by rising demand for craft, premium, and low-alcohol beers

✔️ Increasing consumer preference for sustainable and locally brewed beer options

✔️ Expanding distribution through e-commerce, breweries, and specialty retail stores

Request for a sample copy of the report: https://www.imarcgroup.com/europe-beer-market/requestsample

Europe Beer Market Trends and Drivers:

The European beer market is changing as more people choose craft, premium, and healthier beer options. In 2024, craft beer sales went up by 12%, even with rising prices and supply issues. In countries like Germany, the UK, and Belgium, people are moving away from mass-produced beers and choosing local, high-quality brews instead. This shift is changing the European beer market share, with big beer companies buying small craft breweries or starting their own premium brands.

But the beer industry in Europe is also facing some problems. Costs are going up, advertising rules are getting stricter—especially in Nordic countries—and there’s more pressure to be eco-friendly. To keep up, over 60% of breweries in Europe have started using greener methods. For example, Carlsberg’s “Together Towards Zero” plan aims to be carbon neutral by 2040. These efforts are helping grow the European beer market size.

Health is also playing a big role. In 2024, sales of low- and no-alcohol beers grew by 18%. Spain and the Netherlands are leading this trend. Big companies like Heineken now say their alcohol-free beers make up almost 30% of their sales in Europe. The EU is also supporting this trend with tax breaks for beers under 3.5% alcohol, making healthy choices more popular.

Small breweries still face tough competition from big brands that have more money for ads and new products. To stay in the game, many small brewers focus on being sustainable—using eco-friendly packaging, recycled water, and saving energy. With the EU banning single-use plastics, even big companies like AB InBev are testing new ideas, like edible beer rings. But customers now look for real action, not just marketing claims.

What makes the European beer scene exciting is how it mixes old traditions with new ideas. While craft and premium beers bring back classic brewing methods, the rise of low-alcohol and “functional” beers shows that younger drinkers care about health. Even small breweries are adding alcohol-free options to meet this demand.

Tastes also vary by region. In Southern Europe, people prefer lighter beers. In the North—like Denmark and Finland—health-focused beers with added ingredients like adaptogens are becoming more popular. Online shopping is also growing. Beer subscription services went up by 22% in 2024, though local pubs and taprooms still play a big role in building customer loyalty.

Looking forward, the future of the European beer market looks positive. Growth will depend on how well breweries can keep up with changing customer preferences, control costs, and stay eco-friendly. According to the latest European beer market report, those who adapt quickly will do well. The increasing European beer market size shows that the industry is strong and ready for what’s next.

Europe Beer Market Segmentation:

The market report offers a comprehensive analysis of the segments, highlighting those with the largest Europe Beer Market Growth. It includes forecasts for the period 2024-2032 and historical data from 2018-2023 for the following segments.

Study Period:

Base Year: 2024

Historical Year: 2019-2024

Forecast Year: 2025-2033

Analysis by Product Type:

- Standard Lager

- Premium Lager

- Specialty Beer

- Others

Analysis by Packaging:

- Glass

- PET Bottle

- Metal Can

- Others

Analysis by Production:

- Macro-Brewery

- Micro-Brewery

- Others

Analysis by Alcohol Content:

- High

- Low

- Alcohol-Free

Analysis by Flavor:

- Flavored

- Unflavored

Analysis by Distribution Channel:

- Supermarkets and Hypermarkets

- On-Trades

- Specialty Stores

- Convenience Stores

- Others

Country Analysis:

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

Competitive Landscape:

The market research report offers an in-depth analysis of the competitive landscape, covering market structure, key player positioning, top winning strategies, a competitive dashboard, and a company evaluation quadrant. Additionally, detailed profiles of all major companies are included.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145