Report Overview:

The global

agrochemicals market is projected to reach approximately USD 382.1 billion by 2034, up from an estimated USD 250.8 billion in 2024, reflecting a compound annual growth rate (CAGR) of 4.3% over the forecast period from 2025 to 2034. The agrochemicals market is a crucial component of global agriculture, providing essential inputs such as fertilizers, pesticides, herbicides, and plant growth regulators that help enhance crop yield and protect against pests and diseases. As the global population continues to rise, so does the demand for food, placing pressure on existing agricultural resources.

Key Takeaways:

- Agrochemicals Market size is expected to be worth around USD 382.1 Billion by 2034, from USD 250.8 Billion in 2024, growing at a CAGR of 4.3%.

- Solid formulations held a dominant market position, capturing more than a 67.90% share of the global agrochemicals market.

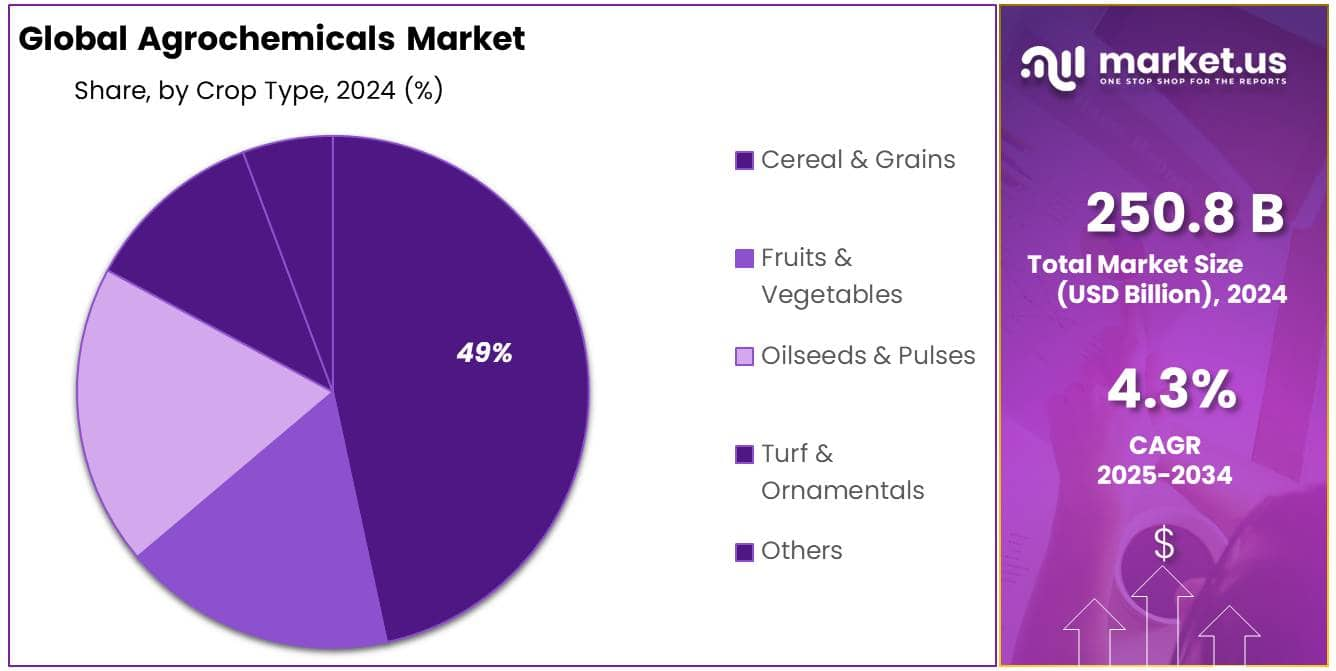

- Cereal & Grains held a dominant market position, capturing more than a 49.20% share of the global agrochemicals market.

- Soil Treatment held a dominant market position, capturing more than a 43.10% share of the global agrochemicals market.

- Asia Pacific (APAC) region is the dominant player in the global agrochemicals market, holding a significant share of 52.40%, valued at approximately USD 131.4 billion.Click here fot more information: https://market.us/report/agrochemicals-market/

𝐂𝐥𝐢𝐜𝐤 𝐭𝐨 𝐑𝐞𝐪𝐮𝐞𝐬𝐭 𝐒𝐚𝐦𝐩𝐥𝐞 𝐑𝐞𝐩𝐨𝐫𝐭 𝐚𝐧𝐝 𝐃𝐫𝐢𝐯𝐞 𝐈𝐦𝐩𝐚𝐜𝐭𝐟𝐮𝐥 𝐃𝐞𝐜𝐢𝐬𝐢𝐨𝐧𝐬:

https://market.us/report/agrochemicals-market/free-sample/

Agrochemicals Market Segments:

Product Type

- Fertilizer

- Nitrogenous

- Urea

- Ammonium Nitrate

- Ammonium Sulfate

- Ammonia

- Calcium Ammonium Nitrate

- Others

- Phosphatic

- Monoammonium Phosphate (MAP)

- Diammonium Phosphate (DAP)

- Triple Superphosphate (TSP)

- Others

- Potassic

- Potassium Chloride

- Potassium Sulfate

- Others

- Pesticide

- Insecticide

- Fungicide

- Herbicide

- Bio-pesticide

- Others

- Plant Growth Regulators

Formulation

Crop Type

- Fruits & Vegetables

- Cereal & Grains

- Oilseeds & Pulses

- Turf & Ornamentals

- Others

Application Method

- Others

- Foliar Spray

- Soil Treatment

- Seed Treatment Market Dynamics:

Driving Factor:

There is a growing global shift toward sustainable agriculture, encouraging the use of environmentally friendly agrochemicals such as bio-based pesticides and slow-release fertilizers. These products help maintain soil health and reduce harm to water systems. According to the World Bank, sustainable practices can minimize environmental impact while maintaining productivity.

Farmers and consumers alike are increasingly favoring these alternatives. As sustainability becomes a core focus of agricultural policy and market demand, companies investing in eco-friendly agrochemical innovations are positioned to benefit from rising adoption, while also aligning with broader environmental and food safety goals

Restraining Factor:

The widespread use of agrochemicals raises serious environmental and health concerns. The WHO reports over 200,000 pesticide-related deaths annually, primarily among farm workers. Additionally, these chemicals can contaminate soil and water, degrade ecosystems, and harm pollinators like bees, which are vital to 35% of food crops.

Regulatory bodies are responding; for example, the EU aims to reduce pesticide use by 50% by 2030 through the Farm to Fork Strategy. Similarly, the U.S. EPA enforces strict pesticide assessments. Growing consumer awareness and environmental advocacy are pushing the market toward safer, more sustainable pest management methods

Growth Opportunity:

The shift toward sustainable and organic farming offers strong growth potential for the agrochemicals market. Demand is rising for organic pesticides and bio-based fertilizers that improve yield without harming the environment. According to FAO, sustainable agriculture could boost food production by up to 58% by 2050. Organic food sales reached USD 120.5 billion globally in 2020, with strong annual growth.

Regulatory support like the EU Green Deal and USDA’s Organic Transition Program is accelerating this trend. As eco-conscious consumers drive demand, companies that develop compliant, effective organic agrochemicals are poised to benefit from this expanding segment.

Latest Trend:

Precision farming is revolutionizing the agrochemicals market by enabling targeted application through GPS, drones, sensors, and data analytics. This approach reduces waste, lowers costs, and minimizes environmental impact. The FAO states such technologies can cut fertilizer use by 10–15% and increase yields by up to 30%. Tools like drones with multispectral sensors help identify specific areas needing treatment, avoiding blanket chemical use.

Supported by government initiatives like the EU’s CAP and USDA’s programs, precision agriculture enhances resource efficiency while aligning with sustainability goals. Its integration into mainstream farming is shaping a more intelligent, responsive agrochemical application model.

Top Key Players:

- BASF SE

- Bayer AG

- Syngenta

- UPL Limited

- Nufarm

- ADAMA Ltd

- Corteva, Inc

- Yara International ASA

- ADM

- Nutrien

- K+S AG

- Sumitomo Chemical Co., Ltd.

- Compass Minerals International, Inc

- ICL Group Ltd.

- Isagro

- FMC Corporation

- OCP Group

Conclusion:

The global agrochemicals market is poised for steady growth, driven by the increasing demand for food due to a rising global population and the need to enhance agricultural productivity. Agrochemicals, including fertilizers and pesticides, play a crucial role in improving crop yields and ensuring food security.

Technological advancements, such as precision farming and the development of bio-based agrochemicals, are transforming the industry by enabling more efficient and environmentally friendly farming practices. Overall, the agrochemicals market is expected to continue its upward trajectory, adapting to evolving consumer preferences and environmental considerations.